Stock exchange Reports, Inventory Suggestions & Change Info

If you opt to buy a positively-managed what does it mean when a frog visits you fund, be aware that the money is also outperform a standard but it can also be and underperform on account of movie director exposure. If the finance movie director loses key personnel or produces an error, this will change the come back of your money. With respect to the Financial World Regulatory Authority (FINRA), you can find 11 different varieties of investments.

We will still push enhanced full earnings while focusing to the EV success improvement generate lingering good totally free earnings. Simultaneously, we’re going to continue to drive American advancement inside the batteries, autonomous technical and you can app. For example, in the Summer i announced $4 billion of new investment inside our U.S. system vegetation to include 3 hundred,one hundred thousand devices out of capacity for large margin white-obligation pickups, full-size SUVs and you will crossovers. This helps all of us meet unmet consumer demand, help reduce all of our tariff coverage, and you will bring upside opportunities as we launch the new models. The capability starts upcoming online within just 1 . 5 years, after which we enterprise strengthening more than 2 million vehicle inside the new U.S. every year as we size. Feedback conveyed try as of the new day conveyed, according to the advice offered by the period, and may change based on market or other conditions.

The investing design: what does it mean when a frog visits you

Although not, with regards to the British’s HM Money and you will Culture Place of work, an organization trader can either purchase on behalf of anyone else or in their own skill. When they invested making use of their membership, chances are they wouldn’t be thought a keen organization investor. While some someone individual their offers, anybody else individual him or her thanks to organization buyers which invest their funds inside the other offers otherwise money account. Bankrate.com is a different, advertising-offered writer and you may evaluation provider.

- An alternative try an appropriate offer that provides the newest package consumer the ability to either pick or sell an asset during the a good specified rates for a specific time frame.

- Additionally it is smart to lose one high-desire debt (such as handmade cards) just before using.

- Alternatively, if you wish to very own private holds, $step 1,100 will be enough to do an excellent diversified collection.

- We are going to consistently drive improved full profitability while focusing to the EV earnings update to create lingering strong totally free earnings.

People going their investment to a wide variety of money automobile, including carries, securities, a property, shared fund, hedge financing, organizations, and merchandise. Investors run into chance once they to go investment, and you can stroll an equilibrium between controlling risk and you will go back. Then, you could potentially dictate disregard the layout and decide whether or not you will want to pick personal holds otherwise fool around with passive money automobile such as replace-exchanged fund (ETFs) otherwise shared fund. After you have selected all that and you will complete particular funding lookup, you could potentially open an agent account and also have been. A primary risk of shared money, common with ties as a whole, ‘s the risk of express prices dropping in line with the property’ decreased well worth.

In some cases, Cds may be ordered to your supplementary market at a high price one to reflects a made to their prominent value. Stock locations is actually erratic and will change notably in reaction to business, world, political, regulatory, industry, or economic improvements. Lender items are small-label investments that can earn interest, along with permits of deposit (CD). Instead, if you’d like to own private stocks, $step one,100000 is going to be adequate to do an excellent diversified profile.

Couch potato Investors versus. Productive People

An individual individual will be any person spending on their own that will get of many versions. A personal buyer spends their particular money, always in the holds, ties, common fund, and you will replace-replaced money (ETFs). Individual traders aren’t professional investors but alternatively those trying to large productivity than easy investment automobile, for example licenses out of put otherwise offers account. Buyers is also get acquainted with possibilities of various other angles, and generally want to do away with exposure if you are improving output.

One to works with the gymnasium and fitness goals, since the most other works with online broker account and you will investment procedures, however, you will find stunning the thing is that. Anyone who has place workout plans and you can pushed by themselves to stick so you can a rigid actual regimen has developed experience one to translate so you can spending pros. We will unpack each one of these thinking, discussing how health can make you a better investor. Sort through the new money’s prospectus to be sure it aligns with your financing expectations and see when the you will find any benefit common money available.

Seven Carries That will Outperform the fresh Fantastic Seven inside the 2025

Neither Fidelity nor any one of their affiliates is actually suggesting otherwise promoting these property by making her or him available. Target Date Money are a secured item mix of brings, bonds or other opportunities one immediately gets to be more old-fashioned because the fund methods their address old age go out and you can past. Traders potentially make money using stocks as a result of unexpected bonus payments (servings away from business winnings paid out to investors) and you can express appreciate, when a trader sells offers for over they taken care of her or him. Investors spend money on several different type of financial property in which they hope to secure an income on their currency.

Someone else could be stock pickers which dedicate according to simple research out of corporate economic statements and you can financial percentages—talking about effective people. They have different risk tolerances, investment, styles, preferences, and you can day structures. For example, specific investors can get choose low-exposure investment which can trigger old-fashioned growth, for example certificates out of dumps and certain bond things. All of the investments incur the risk of loss of particular otherwise all of your own prominent funding, but mutual financing are generally sensed a reliable money because they provide diversity and therefore are controlled because of the SEC.

Now, why don’t we get to the tips you’ll need to test invest currency the right way. Get the biggest technical manner of the century and you will learn how to play hypergrowth stocks that may perfect an alternative age bracket of millionaires. Within this esteem, an important special investor therapy characteristic is chance ideas.

Now, there are 30, and you can Chevrolet turned into the brand new #2 EV brand name from the next quarter, while you are Cadillac became the new #5 EV brand name overall and also the luxury EV commander. The new words investors and you may traders are often utilized interchangeably in the financial news, however, there are several major differences when considering both. Investing currency may sound daunting, especially if you have never over it before. But not, if you work out how we should purchase, how much money you ought to dedicate, as well as your chance tolerance, you are well positioned making wise behavior together with your currency that will assist you well for many years to come. By contrast, stock production can differ generally with regards to the company and you can go out body type.

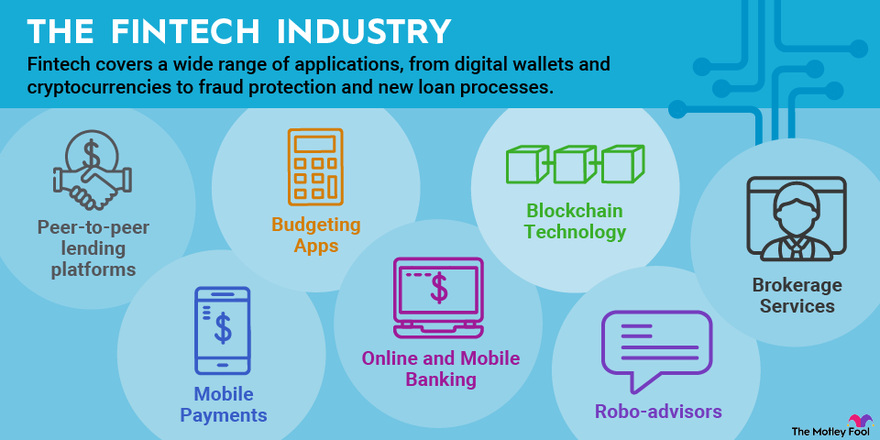

And in case you really would like to get a hands-of method, a robo-mentor might possibly be right for you. There is certainly grand differences in risk, even inside the wider kinds of holds and you will securities. Such as, Treasury securities or AAA-ranked corporate bonds are reduced-exposure opportunities. Simultaneously, a leading-yield thread can cause better income but may come which have a greater risk away from standard. Buyers generally generate productivity because of the deploying funding because the both collateral or financial obligation investment. Equity investments entail ownership stakes in the form of organization inventory that may pay dividends as well as promoting financing gains.